Latest

Displaying 491 to 500 of 844

-

30 Sep 2020

G. Edward Griffin - How the Banking Cartel Fooled America Into Creating the Federal Reserve System

SBTV's guest this week is G. Edward Griffin, author of the bestseller 'The Creature from Jekyll Island: A Second Look at the Federal Reserve'. It is time for those who are unaware to realize how evil the Federal Reserve System is and how it has led the world down the path of modern slavery.

(Read more) -

29 Sep 2020

This Might Be the Last Time Gold and Silver Are at These Prices

Our financial system is like a dam holding back a massive reservoir of debt created by central banks raining money printed out of thin air... but even dams built to withstand 1000-year floods collapse.

(Read more) -

23 Sep 2020

Peter Schiff - Gold is the World's Only Answer When the Dollar Crashes

SBTV spoke with Peter Schiff, CEO of Euro Pacific Capital, about his continued warnings of the greater crash ahead and why gold will be central in the next monetary system that will rise from the crash of the dollar.

(Read more) -

16 Sep 2020

Lynette Zang - Signs of Past Currency Regime Change Are Repeating Today

SBTV's guest this week is Lynette Zang, Chief Market Strategist at ITM Trading. We discuss similar trends leading to changes in currency regimes in the past that are eerily mirrored today pointing us towards an imminent currency reset.

(Read more) -

09 Sep 2020

Jimmy Morrison - The Bigger Bubble Ahead That We Must Face, Prepare Now to Survive It

SBTV spoke with Jimmy Morrison, director, and creator of the film 'The Housing Bubble'. Jimmy shares his awakening story following the Global Financial Crisis of 2008. He shouts with us from the rooftops for people to prepare themselves for the bigger bubble that will burst in the years ahead.

(Read more) -

02 Sep 2020

Gerald Celente - This is a Global Fight For Freedom and Tyranny is Winning

SBTV spoke with Gerald Celente, Founder of the Trends Research Institute, as we discuss the coming trends in gold, silver and where the world is heading towards in the months ahead.

(Read more) -

28 Aug 2020

Jan Nieuwenhuijs - Europe Has Been Preparing a Global Gold Standard Since the 1970s

SBTV's latest guest is Jan Nieuwenhuijs, a precious metals analyst with Voima Gold. Jan has uncovered evidence through his research that returning to a Gold Standard is not far away from the minds of European central banks and it is consistent with gold repatriations in the last decade.

(Read more) -

25 Aug 2020

We are now accepting Swiss Franc (CHF) payments for bullion and storage orders!

We are excited to announce that Silver Bullion now supports Swiss Franc (CHF)!

(Read more) -

19 Aug 2020

Egon von Greyerz - The Coming Implosion of Real Estate, Stocks and Bonds Against Gold

SBTV's latest guest is Egon von Greyerz, Founder of Matterhorn Asset Management. He views the rise in the gold price a damning testament of how badly the global economy is managed at this moment. Gold and silver are the simplest and best safe haven assets today.

(Read more) -

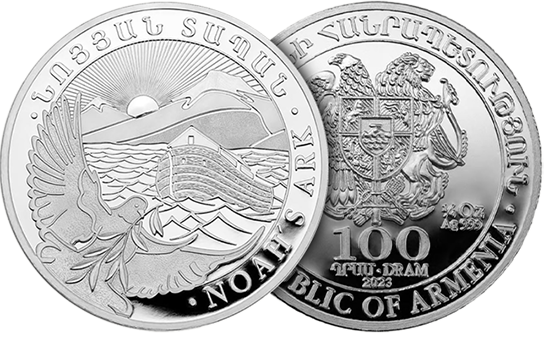

16 Aug 2020

What are Armenia Noah’s Ark Silver Coins?

Armenia Noah's Ark Silver Coins are a popular silver bullion coin issued by the Armenian government. These coins depict the biblical narrative of Noah's Ark, symbolizing the cultural significance and national history of the country.

(Read more)